7 MIN READ

A prospective client called me in February a few years ago.

He had opened a new business in July, and by the time we talked he was selling over $100,000 of merchandise per month. Going from zero to $100,000 per month in seven months is a good thing, right?Not this time.

He called a business coach because he was on the verge of a breakdown. His was a classic case of an owner who didn’t know why he was in business.

There are many subjective reasons for going into business. All are valid and vary from owner to owner. But there is only one purely objective reason, and it is true for every business owner.

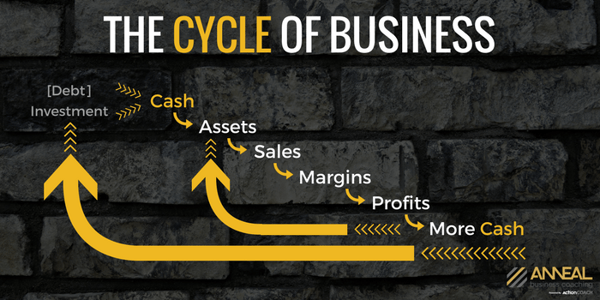

The single, objective purpose of business is to turn cash into more cash*. That’s it.

Notice that I didn’t say “to increase sales” or “to make a profit.”

Business owners often obsess about sales or profit (surprisingly, more often about sales than profit) and neglect the rest of the business cycle set out below.

That’s a mistake because you can’t pay your bills with sales, you can’t make payroll with profit and you can’t meet your subjective goals if you’re broke.

All of those things require cash.

Take a look at the illustration below, and let’s run through the business cycle from beginning to end.

You need cash to start a business and there are two ways to get it:

Debt and investment.

Debt, of course, means you borrow the cash.

Investment means that you or someone else puts up cash in exchange for ownership.

Whatever the original source, the illustration shows that you use the cash to buy assets, which you use to generate sales, which lead to margins, which lead to profit, which leads back to cash. Because of profit, you end with more cash than you started with. You use the ending cash to repay debt, pay a return on investment, or buy more assets to keep the cycle going.

That’s the idea anyway.

In reality, cash gets hung up or leaks out at every stage. Very often, cash barely trickles out the bottom even though the owner continues to pour it in at the top. It doesn’t take long to get too much of that.

It took the prospect who called me about seven months to get too much. When he opened business, he, as many of us do, concentrated his efforts on sales. He was good at it, and even managed decent margins and a nice profit on his books.

So why the meltdown?

Because he was completely out of cash.

Suppliers had him on credit hold, which delayed his orders which had customers complaining and threatening to sue him. He was taking a lot of phone calls and very few of them were good.

How did it happen?

The prospect had done a great job with the entire cycle except the last step - turning profit into cash. He sold goods in a hard-nosed industry that typically allows 45-90 day credit terms.

His merchandise cost him 60¢of each sales dollar, which meant that for every dollar increase in sales, he needed another 60¢to finance the cost of the sale.

The higher the sales, the worse the problem.

By the time he called me, he had over $200,000 in accounts receivable, about $140,000 in past due bills, and zero cash in the bank. This for a company that started business with $31,000 of working capital. Yikes.

You may be thinking “Hey, that’s kind of obvious. Everybody knows you have to manage accounts receivable.”

Maybe so, but it happens all the time. People let receivables get out of control.

Business owners who don’t know why they are in business become obsessed with sales and ignore the rest of the cycle until it’s too late.

Failing to turn profit into cash is just one of the ways businesses get into trouble.

A second way is to ignore margins. Without margins there can be no profit to turn into cash. That too happens all the time.

There is something macho about sales.

I had a contractor client who was obsessed with them. When we met, he didn’t know his costs, therefore he didn’t know his margins, and he would price bids to get the sale. He justified it with statements like: “If I get the sale, I can find a way to keep some of it,” and “I need the sale to keep the guys busy.” Pursuing sales without margins is futile and inevitably leads to disaster.

Tying up too much cash in inventory (an asset), is another common mistake.

I had a client who sold industrial goods to the trucking industry. He understood sales and margins very well. So well that he committed to sales by keeping a large selection of inventory on hand and to margins by buying in quantities that assured the best pricing from suppliers. These efforts assured him good sales and margins - but they also tied up way too much cash because of the low inventory turns that result from excess (and obsolete) inventory. We spent most of a year improving his cash position by getting inventory turns up and inventory levels down.

An imbalance among sales, margins, accounts receivable and inventory are among the most common ways cash either hangs up or leaks out of the business cycle.

But that’s not true for all businesses.

Owners who understand well and pay attention to the full cycle get very good at it. Some are so good that they generate more cash than profit.

For every action you take, you must consider the effect on the subsequent steps in the cycle of business. You have to know that assets efficiently lead to sales, that sales minus cost of goods sold will lead to adequate margins, that margins after overhead will lead to profit, and that profits will quickly convert to cash.

That’s what financial statements are for.

There are three standard financial statements because that’s how many it takes to cover the entire cycle.

Each report has a different purpose and covers different sections of the cycle, but, taken together, they show you how well you are progressing from one stage to the next through the entire cycle.

They can show you where cash is hung up and where the leaks are. Armed with that information, you can focus your efforts on resolving specific problems rather than exhaust yourself by fighting an unspecific general malaise.

Owners who understand the full cycle of business consider every step of the cycle in every decision.

They don’t chase sales for the sake of sales.

They don’t tie up cash in excess inventory.

They don’t compete by reducing their margins.

They don’t let their accounts receivable threaten their businesses.

And they don’t squander cash buying things they don’t need to “save on taxes.”

As a result, they lead less stressful lives than their peers.

When was the last time you worried about making payroll? How much excess inventory do you have sitting around? How much cash would you need to double your sales? How did your last “really big” sale work out? When was the last time you saw a statement of cash flows for your business?

Was this article useful? Can you relate to the issue? As always, I appreciate your stories, questions and suggestions in the comments section below. If you would like to learn more about managing the cycle of business, or, if there is a business subject you’d like to learn more about, please let me know in the comment box below or by email to martin@annealbc.com.

*A business pays you cash in two ways. The first is cash that comes from the profits of operating a business. The second comes at the time you sell your business and convert equity value into cash. Most small business owners have not even considered this second source of cash, even though it has the potential to far exceed the cash produced from operations.