5 MIN READ

"Breakeven is among the most powerful tools we have for making management decisions. "

Break even sales is the point at which we’ve sold just enough to pay all of our expenses, with nothing left over for profit. In other words, it’s the point at which profit and loss equal exactly zero.

Interesting, but why should we care?

It turns out that breakeven is among the most powerful tools we have for making management decisions.

Before we see why, let’s see how to calculate break even for our businesses.

If you scroll down the page, you will see a few numbers. I understand that a lot of us don’t like numbers, but these are just too important to ignore.

If you plan on succeeding in business, suck it up. Sacrifice the few minutes it takes to understand.

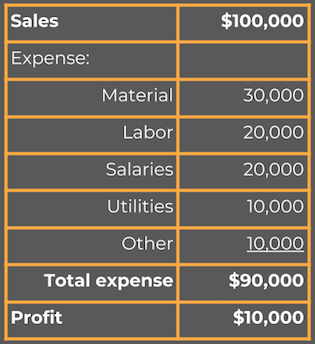

We all know that a profit and loss statement (P&L) shows what’s left after we subtract expenses from sales. If sales are more than expense, we earned a profit, if expenses are more than sales, we have a loss. Many of the P&Ls I see look like this:

This P&L shows $100,000 in sales, $90,000 in expense and a $10,000 profit.

So far so good. But - by looking at the statement, can you tell how much the company had to sell to exactly break even? Remember, breakeven is the point at which sales exactly cover expenses.

If you guessed $90,000, thank you, you obviously gave it some thought. That’s a logical answer because $90,000 of sales minus $90,000 of expense equals zero, and zero sounds a lot like breakeven.

Unfortunately, it’s not that simple because if sales declined to $90,000, expenses for material and labor would also decline. That’s because material and labor are variable expenses that move up and down with sales.

If we double our sales, we double our variable expenses. If sales go to zero, variable expenses go to zero.

“Okay,” you say, “if expenses go down to $90,000, I’ll just reduce my guess to compensate,” but if you reduce your guess, material and labor expenses would go down further.

Using this method, you would constantly be chasing a moving target. You can see that it is very difficult to find breakeven from even a simple P&L arranged like this one.

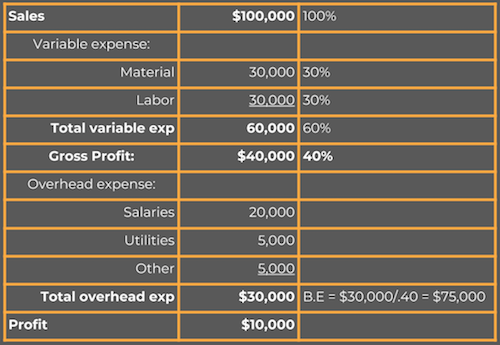

Some really smart people recognized the problem and figured out how to solve it. They rearranged the P&L to separate variable costs from overhead costs that stay the same regardless of sales. The rearranged P&L from above looks like this.

This simple adjustment is very important because it enables us to calculate those percentages shown on the right. Each one represents the adjacent number as a percentage of sales. (Quickbooks calculates them with one click of the mouse.)

The percentage we are most interested in is gross profit as a percentage of sales (called margins), which you can see is 40%. That tells us that only 40¢of each sales dollar remains after labor and material. We use that 40¢, first to pay overhead, then, after all overhead is paid, to accumulate as profit.

Now we’re getting somewhere.

"Sacrifice the few minutes it takes to understand the numbers."

If each dollar of sales provides 40¢, our break even is our total overhead divided by 40¢. The numbers for this example are $30,000 divided by 40¢ = $75,000 = Break Even.

If this company had sold $75,001, that one extra dollar of sales would result in a 40¢ profit. If it had sold $75,002 it would have earned an $.80 profit and so on.

So that’s how we calculate breakeven, but why should we care?

The first reason is that understanding break even changes our behavior.

In our example, the company had to reach $75,000 in sales to break even. That was 75% of their total sales effort that month, so it was likely they were either feeling tired or pretty good about themselves.

Either way, they may have been tempted to back off a little and relax.

But Nooooo….

Even though they had seventy five percent of their sales in the bag, they hadn’t earned a penny of profit yet!

Nothing. Nada. Zip.

The lesson is that before breakeven none of the margin is profit. After breakeven, all of it is profit. Break even is pedal-to-the-metal time. It’s the time to double-down and sell more before the overhead meter resets on the first of the next month.

In terms of profit, that extra job we squeeze into a month is worth far more than the first job we did that month.

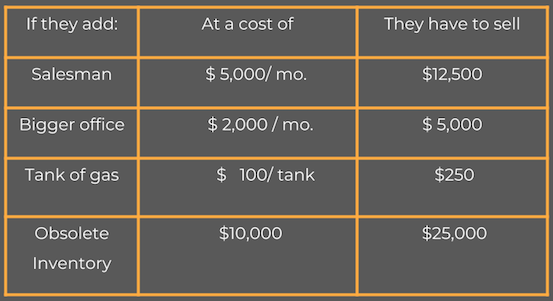

The second reason is that breakeven provides valuable insight for making decisions, particularly about expenses.

The impact of expenses includes not only the cost involved, but also the increase in sales required to recover the cost. Spending money is easy, recovering it through sales is the challenge.

Decisions look completely different when the question “How much does it cost?” becomes “How much do I have to sell to pay for it?”

That is the true test.

To see how breakeven informs decisions, look at the examples below. The second column is the cost of an additional expense, the third column is how much our example company has to sell to break even on the additional expense:

There are many, many more uses for break even - employee incentive bonuses, price increases, price decreases, marketing opportunities, and more, but you get the idea.

My clients are routinely startled by the insights break even reveals and the guidance it provides for routine decisions.

What is your break even? What day of the month do you break even? How much more do you have to sell to pay for that new Platinum F150? What is the quota for your new salesman? How much do you have to sell to pay for an advertising campaign? How much more do you have to sell to double your profit? The answers to these questions may surprise you.